2023 looms as a crossroads for coin collecting with economic variables, including domestic and world events, all playing a part.

We continue to see an emphasis on coins representing calamity and survival hedges. Consequently, the Saint-Gaudens double eagle gold coins, both common and rare, are featured in multiple picks. Ultra-high-net-worth persons have held a commanding and growing coin market presence over the last decade. Demand from this sector for high-grade early U.S. gold coins has been feverish and unabated.

The Heritage Auctions (HA.com) public sale of the Harry W. Bass, Jr. Core Collection, realized $20.5 million for just 105 lots, with 70 of those being rare U.S. gold coins. The sale and its prices represent one of the most important gold coin benchmarks of the decade.

Anyone looking at valuable U.S. coins as a collectible and investment would have to focus on early U.S. gold coins as a top pick.

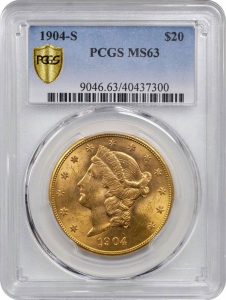

All coins referred to have been certified by the Professional Coin Grading Service (PCGS) or the Numismatic Guaranty Company (NGC). These firms rate coins on a scale of one through 70, where one refers to a coin that is barely identifiable and 70 is perfect. Proof refers to a method of manufacture by the Mint and is not a grade. The Certified Acceptance Corporation (CAC) affixes green stickers to PCGS and NGC holders of coins it feels are solid or high-end for the grade.

1. Early U.S. Gold Coins

Early U.S. gold coins are attractive collectibles – both aesthetically and as investments – in grades from About Uncirculated (lightly circulated) condition through Mint State-63, 64, and 65 (Gem). These are the most important coins in the marketplace. They will remain so irrespective of gold’s price performance.

Mint-state early gold coins are rare, have a solid collector base, hold appeal for investors and enjoy an outstanding track record in the marketplace. What sets them apart is their dazzling appearance. Early gold coins graded About Uncirculated are beautiful, but in MS-63, 64 and 65, they can be miniature works of art.

These coins have been on fire for close to two decades. Everyone who can afford them wants to buy them, and collectors, investors – and even dealers – sometimes throw away pricing guidelines and comparables when they bid on them at auctions.

The Mint Act of 1792 provided for the issuance of three gold coins: an eagle ($10 gold piece); a half eagle ($5 gold piece); and a quarter eagle ($2.50 gold piece). The eagle and half eagle made their first appearances in 1795, with the quarter eagle joining in 1796.

Other denominations, most notably the double eagle (or $20 gold piece), came later. These three coins formed the cornerstone of U.S. gold coinage. They were the only ones produced before 1849.

At the Heritage sale in Long Beach, an 1821 Capped Head Left, $5 gold piece, Gem Proof 65 Cameo brought a record $4.62 million. The previous record was $198,000. An 1804 Capped Bust Right, $10 gold piece, grading Proof-63 sold for $2.28 million.

A Gem Mint State-65+ example of the popular and highly collectible 1801 $10 gold piece realized $288,000. Mint State-60 and higher grade examples of this date and type should rank among the top performers in 2023.

2. Type 3 Liberty Head $20 Gold Pieces Graded Proof-65

Proof U.S. gold coins are rare and expensive. These coins are dazzling in any denomination, but because of their size and heft, proof double eagles (or $20 gold pieces) represent the ultimate in mint-making magnificence. These coins contain very nearly an ounce of gold and, being proofs, are superior specimens both technically and aesthetically. These coins are rooted in the mid-19th century, and their issuance spanned a period of more than half a century when the nation fought and survived a bloody civil war, won the American West and expanded from sea to shining sea.

Collectors divide Liberty $20 gold pieces into three types. From 1849 to 1866, the coins lacked the motto IN GOD WE TRUST; the motto then appeared until the end of the series in 1907, and from 1877 until the end, the statement of value was shown as TWENTY DOLLARS, rather than TWENTY D. This last group, known as Type 3, is recommended.

A Gem Proof-65 example costs about $250,000 today, but with mintages ranging from a low of 20 to a high of just 158, these coins are rare. A year ago, a Gem Proof-65 example would have cost $150,000.

David Hall, founder of PCGS, speculates the Gem Proof-65 Liberty Head $20 gold pieces could be valued at $1 million in a decade.

3. Common Date Saint-Gaudens $20 Gold Pieces Graded Gem Mint State-65

Not long ago, common-date Saint-Gaudens double eagles would have been considered losers in the highly desirable grade of Mint State-65. Although the coins bear a beautiful design, the problem was that prospective buyers were reluctant to pay big premiums for coins with relatively high mintages. Now, the surging price of gold has stimulated investor interest in precious metals, even in the $1,600 range.

Saints are enjoying a stable market cycle, and currently are bringing over $3,000 in MS-65 with CAC verification.

If gold declines these coins could decline in value. Gold’s price will decline with a stronger U.S. dollar and higher interest rates, irrespective of inflation. But if the Fed eases off the rate increases and inflation continues unabated, watch out. Gold could increase impressively and so could the MS-65 Saints.

CAC-verified common date MS-65 Saints have provided considerable downside protection against gold’s price decline, as the CAC $3,000 value has been present since gold was over $2,000 per ounce in 2020.

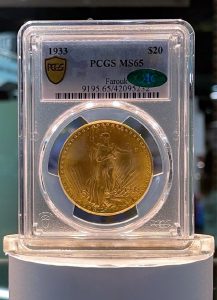

4. 1933 Saint-Gaudens $20 Gold Piece

The 1933 double eagle ($20 gold piece) sold at auction twice is the only specimen legally in private hands.

It brought $7.59 million at auction in July 2002. At the time, that was the highest price ever paid for a single coin at public auction. In 2021, it was sold again at public auction and realized $18,872,250.

There are indications that 1933 double eagles are being held clandestinely by coin dealers, collectors and other private individuals.

Ten of these coins now being held by the government, and possibly still more currently in hiding, appear to all be government property, based on court rulings.

The 1933 double eagle wasn’t born rare; it had a healthy mintage of 445,500. But before the Mint could release them, President Franklin D. Roosevelt issued his Gold Surrender Order halting production of gold coins and recalling those held by private citizens, except for coins of numismatic value. Virtually the entire mintage of 1933 Saints was melted.

The 1933 double eagle has become a numismatic icon and trophy, much like the 1804 silver dollar and the 1913 Liberty Head nickel.

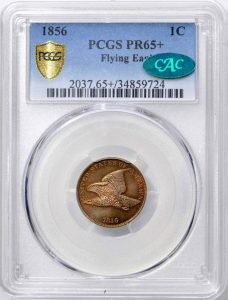

5. 1856 Flying Eagle Cent in Proof-63

THROUGH 65+ By the 1850s, the large copper cent had worn out its welcome. The U.S. Mint conducted tests to find a suitable substitute and settled at length on a smaller coin made from an alloy of 88% copper and 12% nickel. The coin was the same diameter as the current Lincoln cent, but thicker and twice as heavy. It carried a portrait showing an eagle in flight and is known as the Flying Eagle cent.

The Flying Eagle cent wasn’t struck for commerce until 1857. However, the Mint produced small quantities of the coin in 1856 for presentation to members of Congress, Treasury officials and other dignitaries.

Researchers estimate more than 600 were distributed and hundreds of restrikes were made a few years later, using the same dies, for sale to collectors of the day for a combined total of possibly 1,500 – all proofs.

This is the nation’s first small-size cent. Prices are far from cheap: $25,000 in Proof-63, $40,000 in Proof-64 and $50,000 in Proof-65.

Discontinuance of the Lincoln cent should propel this small cent to great heights in 2023. Copper coins exposed to moist environments, even in grading service holders, deteriorate rapidly. Flying Eagle cents are considerably more stable.

6. Smartly Priced Lower-Mintage American Eagle 1-Ounce Bullion Coins

American Eagle bullion coins first appeared in 1986 when the U.S. Mint introduced the one-ounce silver Eagle plus gold Eagles in four different versions: the basic one-ounce size and subsidiary sizes of ½, ¼ and 1/10 of an ounce. The platinum Eagle was added in 1997 and comes in the same four versions.

All of the non-proof American Eagles vary in price according to the value of the metal they contain.

In theory, bullion coins are not numismatic and bring no added premium as collectibles. In practice, some collectors place value on certain bullion coins when their mintages fall significantly below the normal production levels for their series. This premium may be modest, but has potential to rise if a particular series continues to be produced and grows in popularity.

An example is the 2021 first oneounce American Gold Eagle struck of the new design featuring Jennie Norris’ bold Eagle Portrait on the reverse. The coin brought $100,000 at auction.

These coins are only recommended if you pay no bonus premium over the regular surcharge, and only if you buy them when the price of bullion and the premium over bullion is not inflated.

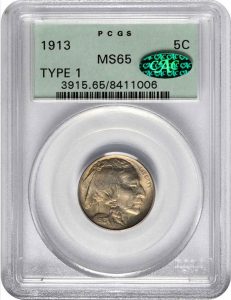

7. One-year Type Coins

In recent years, many collectors have abandoned date-and-mint collecting and turned instead to assembling sets of “type coins.” These sets contain just one example of a particular coin or one example of every major type within that series.

Major types are often one-year issues like the 1913 Buffalo nickels that were corrected even before that year’s end when they proved too prone to wear on the raised mound. Since demand is high and supply is limited, there’s upward pressure on their value.

Some are relatively common; the Type 1 Buffalo nickel isn’t a scarce issue. Others are rare, including the 1796 Draped Bust quarter and the 1916 Standing Liberty quarter.

8. Common Date Type III Liberty Head $20 Gold Pieces Graded Mint State 60 Through 63

The double eagle began in 1849 as a way to use the gold pouring into the marketplace because of the California Gold Rush. Congress authorized two new gold coins—this nearly oneounce coin and the tiny gold dollar. The design of the Liberty Head double eagle remained much the same throughout its more than 50-year run, but collectors recognize three distinct types. The original version gave way to Type II in 1866 when the motto IN GOD WE TRUST was added to the reverse. In 1877, Type III came about when the statement of value was changed from the shorthand TWENTY D. to TWENTY DOLLARS.

If gold bullion decreases in value, you can reasonably expect common date Type III Liberty Head double eagles graded Mint State 60 through 63 to be big losers if purchased when gold was higher. But with gold on the rise, this could pay off.

A common date Liberty Head Type III $20 gold piece carries a value of $2,050 in MS-61; $2,075 in MS-62; and $2,100 in MS-63, with gold at $1,666 per ounce.

These coins provide some price protection even when gold decreases.

9. The 1792 Half Disme, Circulated Condition

As its name suggests, the half disme was precisely half the weight of the dime and the same metallic composition. The nickel five-cent piece proved more convenient and popular in 1866, and the half dime was discontinued seven years later. When it first appeared, this small silver coin saw widespread use in commerce.

The very first half disme is seen by many as the first U.S. coin of any kind. It was reportedly struck in the cellar of a Philadelphia home in July 1792 – months before the opening of the nation’s first mint in that city. The 1,500 pieces made had congressional authorization and were minted from silverplate provided by President George Washington.

These coins bear the inscription HALF DISME, “disme” being French for “tenth” (as in tenth of a dollar).

The Mint later anglicized this to “dime.” The 1792 half disme is rare, historic and desirable.

The mystery of each well-circulated 1792 half disme drives prices up for collectors who want the worst condition, most well-circulated examples. Did George Washington hold this coin? Was it manufactured from the silver in Martha Washington’s teeth?

In 2021, a Fair-2 example found in a dealer’s junk box and sold for under $1 sold at a GreatCollections.com online auction for $104,625.

10. 1936 Walking Liberty Half Dollar Graded Gem Proof-65

Proof Walking Liberty halves are breathtaking coins. The U.S. Mint agrees, for in 1986 it chose the obverse portrait from the Walking Liberty coin, with its full-length view of Miss Liberty, for the obverse of the American Eagle silver bullion coin. The Saint-Gaudens design was chosen for the gold American Eagle, so this was a powerful statement that in the government’s view, the “Walker” stands at the head of the class among U.S. silver coins.

11: PCGS and NGC Registry Set Coins

Registry sets are sets containing coins certified and rated by PCGS or NGC that allow collectors and investors to showcase their sets online through registry listings.

Many collectors compete with each other because each collector wants to boast of having the best set.

Look for a continued increase in both demand and value for coins that make up registry sets.

12. Capped Bust Quarters, Underrated Varieties

Bust coinage dates to the earliest days of the U.S. Mint and was manufactured from 1792 to 1839.

In some cases, Bust silver quarters are easy to locate, but others are scarce and rare. An 1828 Capped Bust quarter of the Browning 3 variety that was manufactured using the 1822 reverse die is a prime example of an underrated variety.

The reverse shows 25 cents over 50 cents as an engraving error. The original engraving was of the 50 cents denomination, but the engraver later corrected it to be 25 cents because the coin being manufactured was a quarter.

According to collector and coin variety book author, Barry Sunshine, this variety has fewer than 60 known and the highest graded is a Mint State 63. He speculates that as more collectors use online valuation data being released in 2023, varieties of this type will become more mainstream collectibles and easier to price.

This article about the top 12 coins to make money in 2023 previously appeared in COINage magazine. To subscribe click here. Article by Scott Travers.