Investing in platinum is something many wonder whether it is a wise decision. The same questions are asked about investing in silver, gold coins and rare coins. Platinum demand is expected to grow 24% this year as the global automobile and truck markets, prime users of that metal, are improving faster than expected. Automotive demand for platinum increased 12% in 2022, largely because of a 28% increase in the manufacture of hybrid vehicles. Global automotive demand is expected to increase by another 10% by the end of the year. Other industrial demands are expected to rise 12%.

Much from LCDs, the glass industry, chemicals, petroleum and electronics.

Although platinum has been a fairly flat market over the past two to three years, a recent World Platinum Investment Council Report says the balance of supply and demand is turning in Platinum’s favor in 2023. “After two years of significant surpluses, the platinum market is forecast to move to a material deficit in 2023,” the report said.

The market will move from a 776,000-ounce surplus in 2022 to a 556,000-ounce deficit in 2023, a swing of over 1.3 million ounces in a narrowly traded metals market.

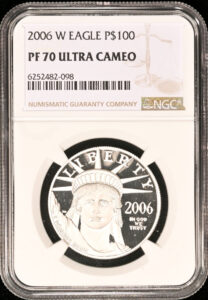

Platinum Bar & Coin Demand Expected to Double

Platinum Bar & Coin Demand Expected to Double

The biggest demand growth is forecast for investments. Platinum bar and coin demand are forecast to double to 450,000 ounces this year, although platinum Exchange Traded Fund (ETF) outflows may cut into that rise. There should also be a huge demand for platinum jewelry in China, which will now be wide open for pent-up consumer demand this year and next. Jewelry demand is expected to rise 15% in China. Smaller growth rates are expected in Japan and India.

Platinum closed 2021 at $968, and it closed 2022 at $1,031; so it managed a 6.5% gain despite a strong U.S. dollar for most of the year. Platinum was rescued when the dollar started to fall in the fourth quarter of 2022.

The other main contributor to platinum’s roller-coaster ride in 2022 was Russia’s invasion of Ukraine. Russia produces about 11% of the world’s platinum each year, making it the number two supplier behind South Africa. For that reason, the price of platinum spiked to $1,170 on March 8 before settling to an 18-month low of $840 in July, as there were no globally coordinated sanctions against Russia.

Platinum & Global Politics

Platinum & Global Politics

Platinum retreated to $981 per ounce on March 31, 2023. The price should return to its long-term plateau above $1,000 based on supply and demand forces, helped by a weaker dollar with the added wild card of serious sanctions against Russia. Should Russia launch another large invasion of Ukraine, it could force platinum prices higher.

If Russia escalates its war against world public opinion, some more serious form of coordinated global sanctions against Russian exports of platinum and palladium could follow. However, in the past, Russia has found a way to sell platinum to third parties who would resell the metal under another national stamp.

Supply Chain Challenges

A return to normal global growth and affordable vehicles with free-flowing supply chains would be the greatest boon to platinum demand in catalytic converters.

How high can platinum go this year? One bold prediction comes from the Australian bank, ANZ, which indicates platinum could reach $1,375 by September 2023. Others are more modest, in the $1,020 to $1,150 range.

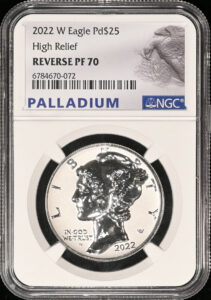

Palladium: A Thinly-Traded Platinum Group Metal

Palladium: A Thinly-Traded Platinum Group Metal

Most world palladium demand (about 70%) comes from catalytic converters in the automobile sector. About 10% of demand comes from the electrical industry; 10% from the chemical industry; and 10% from jewelry demand and investments. Total demand runs at about 10 million ounces or 300 metric tons per year. So the supply is thin when met by any surge in demand. That leads to huge price spikes or rapid price declines.

Palladium’s high volatility is mostly because of its ultra-thin market, compared to other precious metals. Palladium is almost 15 times scarcer than platinum and it is often found only as a byproduct of platinum extraction. Palladium is more of an industrial metal, but any surge in investment demand can serve as a strong trigger that sends palladium prices rapidly soaring or quickly retreating.

Since 2020, we’ve seen 40%+ price swings, up or down, five times in just three years.

Palladium rallied 63% in 60 days in early 2022, mostly after Russia invaded Ukraine, but then fell 40% by mid-year when no major sanctions on palladium or platinum followed.

Russia is the world’s second-largest palladium producer, accounting for 28% of the palladium supply in 2021, the year before the Russian invasion. Investors were expecting a massive shortage to follow the invasion, but that shortage hasn’t materialized.

Investors are wary of this somewhat unpredictable metal that can rally on a dime but also fall rapidly. To some, this is not a buy-and-hold metal but a speculative metal, and trading triggers can be based on unsubstantiated rumors.

After showing these examples of volatility, you would think I would advise you to stay away from palladium and just trade the metal if you can master market timing. That’s a dangerous game for even the savviest trader, but staying away from palladium is not the best option. Just like gold, platinum or silver, palladium is a strong “buy and hold” metal.

If you had simply bought palladium at the start of 2017 when it was $706, you would have doubled your money in the past six years – better performance than with gold, silver or platinum over a moderate time.

My advice regarding palladium bars and coins is to buy low, hold and then ignore the price swings.

This article about investing in platinum previously appeared in COINage magazine. To subscribe click here. Article by Mike Fuljenz.