Rare date U.S. gold coins fared well in public and private sales during the first four months of 2021 and have been ahead of rare date silver and copper U.S. coins, some prices of which have been going down. I am not referring to Great Rarities or the rarest gold coins. I am referring to coins that are rare in comparison to other coins of the same type. Some rare date coins are rare in all grades. Most are comparatively rare, and others are condition rarities.

A 1909-S VDB Lincoln cent is not rare. Tens of thousands are around. It is as comparatively rare as all other Lincoln cents, except particular errors and early Proofs are much more common.

What are Rare Date Coins?

Among types of gold coins, rare dates are comparatively scarcer than most of the other dates of the same type. Many rare dates are true rarities, not just comparative rarities, such as 1920-S, 1921, 1927-D and 1930-S Saint Gaudens double eagles. Examples of rare dates that are not truly rare are 1911-D $2.5 gold coins, 1909-O $5 gold coins, and 1911-S $10 gold coins. The 1915-S $10 gold coin is a condition rarity in Mint State grades. A condition rarity may count as a rare date, as long as it is scarcer in sum than the most common dates of its design type.

1909-O Indian Head

The 1909-O Indian Head $5 gold coin is a rare date, though it is not rare, and it is an extreme condition rarity in MS-64 and higher grades. On January 20, 2021, Heritage Auctions sold a CAC (Certified Acceptance Corporation) verified, PCGS (Professional Coin Grading Service) graded MS-64+ 1909-O $5 gold coin for $240,000. It was from the famous collection of Bob Simpson, co-owner of the Texas Rangers baseball team.

The combined total of 1909-O fives graded MS-64 by PCGS or NGC is fifteen, and this is the only one that was certified as MS-64+. The NGC census does not list a 1909-O $5 gold coin higher than MS-64. The PCGS population reports list three as MS-65 and one as MS-66.

CAC lists two as MS-64 including this PCGS certified MS-64+ 1909-O, and just one higher. CAC considers coins that have already received numerical grades from PCGS or NGC and are submitted to CAC. A submitted coin that CAC experts find to be ‘solid’ for its PCGS or NGC grade receives a green sticker.

At CAC, the plus of each plus grade designated by PCGS and NGC is ignored. Back in January, this “MS-64+” 1909-O was the only ‘MS-64’ 1909-O that was CAC verified as MS-64. Therefore, the $180,000 CPG-CAC retail price estimate in the February 2021 issue of The CAC Rare Coin Market Review (Vol. III: No 1, CDN Publishing) was an estimate of the retail value of this one coin, which realized $240,000 on January 20, 2021.

1808 $2.5 Gold Coin

In this same Heritage auction in January, a CAC verified, PCGS graded AU-53 1808 $2.5 gold coin realized $204,000. This same coin, evidently in the same PCGS holder, was auctioned by Heritage for $103,500 on July 31, 2008. Market prices were much higher on July 31, 2008, than they were from 2016 to 2020. Even so, the auction price for this coin in January 2021 was almost double the price the same coin realized in July 2008, around the time that markets for rare U.S. coins reached all-time highs.

1921 Saint Gaudens $20 Gold Coin

January 21 was notable, too, for Heritage auctioning a PCGS graded MS-62 1921 Saint Gaudens $20 gold coin for $97,318,20. Previously, Heritage sold PCGS graded MS-62 1921 Saints for $87,000 in August 2020; $88,125 in June 2017; $82,250 in February 2017; $91,062.50 in January 2017; and $85,188 in October 2016. I saw the coin that was auctioned in January 2021. In my opinion, it is not suitable for an upgrade.

The sale of this coin does not prove that prices for 1921 Saints or any other coins have increased; a review of the just listed auction prices, however, is evidence that its value went up in 2021. Many auction records, information about private sales, interviews of market players, and input from other sources are needed for an already knowledgeable analyst to interpret trends in coin markets. There is strong evidence that new buyers of ‘rare date’ gold coins have entered the marketplace in 2021, and some of them have spent large sums.

1854 $3 Gold Coins

On March 25, Stack’s-Bowers sold one of two CAC verified, PCGS graded MS-66 1854 $3 gold coins for $36,000. Heritage sold the other on June 17, 2021, for $32,730. I estimate that these have gone up in value since 2019, probably in 2021.

Also on March 25, Stack’s-Bowers auctioned a PCGS-certified Proof-64-Deep Cameo 1863 $5 gold coin for $102,000.

This is a cool coin. Probably, this 1863 five was never dipped. It has great contrast, texture and natural color. The attractiveness of this coin, however, is beside the point that this is not a ‘top pop’ that was subject to runaway bidding. There are other higher grade Proofs of the same design type. The price realized for this 1863 $5 gold coin in 2021, $102,000, was significantly higher than fair retail prices for it in 2019 and 2020. It is likely to be a fair example of a Proof ‘No Motto’ $5 gold coin that has gone up in value.

1874 $5 Gold Coin

On March 25, the price realized, $51,600, for the finest known business strike 1874 $5 gold coin is relevant to the point that some people were aggressively buying ‘rare date’ gold coins from January to April 2021. This CAC verified, PCGS graded MS-64 coin realized around twice the retail value of a MS-63 grade 1874 five. Also, the CPG-CAC retail value was $42,000.

1846 Charlotte Mint $2.5 Gold Coin

On March 26, Stack’s-Bowers auctioned a PCGS graded AU-55 1846 Charlotte Mint $2.5 gold coin for $12,000. The last PCGS graded AU-55 1846-C $2.5 gold coin to be auctioned was by Heritage in September 2016, for $8,225. In January 2008, when market prices for rare U.S. coins were much higher than they were from 2016 to 2020, Heritage auctioned a PCGS graded AU-55 1846-C for $8,050. The auction price on March 26, 2021, $12,000, may reflect a hefty increase in value of 1846-C $2.5 gold coins.

In this session on March 26 in Las Vegas, Stack’s-Bowers auctioned a CAC verified, PCGS graded MS-65 1888 $3 gold coin, with a blue PCGS label, for $16,800. On January 21, 2019, Heritage auctioned a different CAC verified, PCGS graded MS-65 1888 $3 gold coin, with a blue PCGS label from the same era, for $9,000. This is significant circumstantial evidence of a price increase.

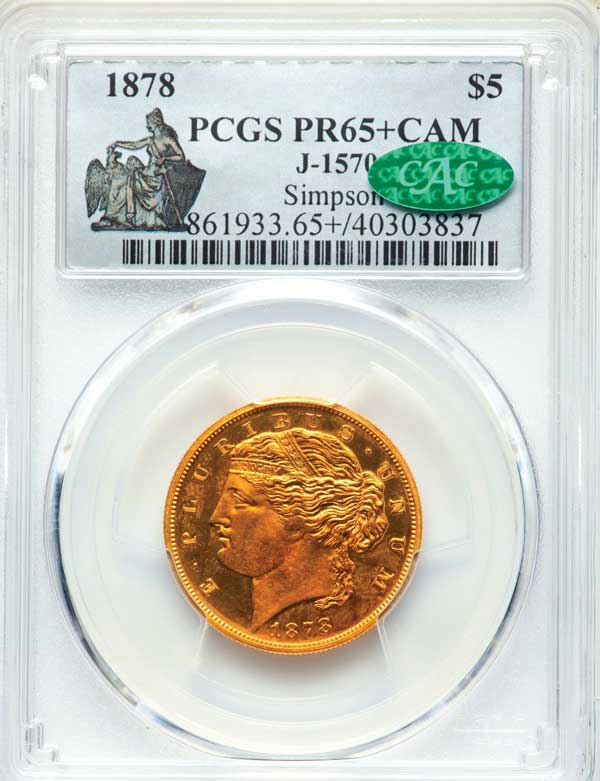

Judd-1570

On April 23, Heritage auctioned a unique pattern in gold of a $5 gold coin, a proposed design that was never accepted for regular production. This 1878 $5 gold pattern is generally referenced as Judd-1570. The tenth edition of the Judd book was published by Whitman around 2008.

The designs of both sides of the J-1570 pattern are unlike those of regular $5 gold coins, though do bear some similarity to designs of U.S. coins of other denominations.

This J-1570 pattern (proposed) $5 gold coin was PCGS certified as ‘Proof-65+ Cameo’ and was verified by CAC. It was auctioned by Heritage for $402,000 in January 2007, at a time when market prices for patterns were higher than they have been at any time since 2008. Certainly, market prices for U.S. patterns in 2018 and 2019 were much lower than they were in 2007. As far as I know, no pattern buyer was expecting this coin to realize as much as $400,000 in April 2021. The $456,000 price realized is an example of someone paying a large amount for a U.S. gold rarity and probably an example of a price increase in 2021.

On April 24, Heritage auctioned a CAC verified, PCGS graded MS-64+ 1808 $5 gold coin for $63,000. This is a wonderful coin, with impressive originality and great luster. Before the auction, the PCGS price guide value for a “MS-64+” 1808 five was $47,500. There is a good chance that the value of this coin went up in 2021.

1870-CC Liberty Head $20 Gold Coins

Also on April 24, the prices realized for two 1870-CC Liberty Head $20 gold coins are central to the theme of large amounts having been spent on rare date gold coins in 2021. The 1870-CC twenty is a crystal clear example of a rare date, for collectors of ‘With Motto’ Liberty Head gold coins and for collectors of Carson City Mint coins, a popular specialty.

One of these two 1870-CC twenties was NGC graded XF-40. The same coin was auctioned by Heritage for about $184,000 in January 2010. Prices for rare U.S. coins generally headed upwards from late 2009 to the middle of 2015 and then began heading down. In August 2019, Heritage auctioned a PCGS graded XF-40 1870-CC $20 gold coin for $240,000, and that was considered a high price at the time. The same coin that realized about $184,000 in 2010 brought $360,000 in April 2021, nearly twice as much and perhaps far more than the same coin would have realized if it had been auctioned in 2018 or 2019.

The other 1870-CC $20 gold coin was NGC graded XF-45 and realized $384,000 on April 24, 2021. Seven years earlier, Heritage auctioned the same coin with the same NGC identification number for $282,000. Market prices for rare U.S. coins in general, not for every coin, were higher in April 2014 than they were from 2016 to 2020. It is fair to say that this 1870-CC twenty brought far more in this auction in April 2021 than its retail value in 2020 or 2019.

Gold Coin Market

While I have identified examples of ‘rare date’ U.S. gold coins that were very likely to have gone up in value during the first four months of 2021, other experts could find examples of some rare date U.S. gold coins that probably did not rise in value. A major point is that rare date U.S. gold coins went up in value on average.

Also, market conditions for rare date gold during June and July were ambiguous. There was not a clear trend. It will be interesting to see how ‘rare date’ U.S. gold coins fare during the last half of the year.

This article about how much are gold coins worth previously appeared in COINage magazine. Click here to subscribe! Story by Greg Reynolds.