By James Passin

Gold’s gradual ascension in 2020 has been attributed by the mainstream media to various short-term risk aversion catalysts, such as proxy military confrontation with Iran or the horrifying coronavirus pandemic, first in China, then Italy, and now the U.S. While these are all serious matters, “knee jerk” capital market reactions inevitably fade and mask the true underlying driver of the stealth bull market in gold: the beginning of the great and irreversible unraveling of the global fiat monetary system.

At the January 2020 highly successful and exceptionally well-run Florida United Numismatists (FUN) Convention in Orlando, Florida, which I addressed, I noticed a markedly better tone on the trading floor than during 2019; my coin dealer friends told me that there a was a lot of business getting done and stronger buying interest than in any previous convention in recent years.

Evolution of the Gold Market

While this new buying interest has not yet changed the level of premiums in the gold coin market, it may represent another manifestation of the evolving dynamics of the physical gold market.

The absorption of the irrationalist and apocalyptical cult that lurks under the green banner of environmentalism by the Palo

Alto-based tech cartels and the exporting of this fanatical doctrine throughout all social media platforms and search engines has set the stage for the hijacking of monetary policy by so-called green policy objectives, which will result, at least in my opinion, in a death spiral of inflation and fiscal waste.

Major governments, led by the United States, continue to wrack up ever greater debt loads, while central banks continue to execute “unconventional” monetary policy, such as quantitative easing, causing unprecedented distortion in financial markets, pushing interest rates to zero or even negative levels. Rather than using this historically low-interest-rate environment to refinance long-term liabilities and using the proceeds to finance productive investments, major governments are going all-in on financial oppression and fiscal largesse.

Non-Fiat Monetary Systems

Gold and bitcoin are both examples of successful non-fiat monetary systems and represent assets that are not someone else’s liability. The quiet reemergence of Hard Assets as an asset class is another manifestation of the growing rejection of the Age of Oppression by the ever-growing New Silent Majority.

The major swings in gold have historically been characterized by an 8x move from each low. Assuming that the January 2015 low of $1,103 represents the Major Low of the current move, I can project the next Major Top at $8,824. In my view, over the next decade, we will see gold trading in the $7,000 to $9,000 range.

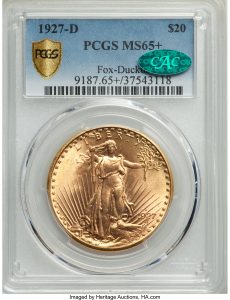

I continue to see historic value opportunities in the physical gold market. In particular, one of the very best balanced values at this time are Mint State-65 common date Saint-Gaudens double eagle gold coins sporting the CAC (Certified Acceptance Corporation) green hologram. This combines the best of an affordable vintage Gem collectible coin with high gold content (0.9675 oz. gold).

With gold in the $1,550 range, adding an additional $1,000 or so for an MS65 CAC Saint represents extraordinary value. Kudos to CAC founder John Albanese and his grading team for keeping CAC’s grading standards tight and consistent.

Platinum Piques Attention

Platinum remains extraordinarily cheap compared to gold, as well as palladium and rhodium. The palladium/platinum ratio is unsustainably stretched and set up for a massive and lasting reversal. I continue to like 5- and 10-ounce platinum bars and Canadian Maple Leaf 1-ounce platinum coins for their low premiums over melt. The unrelenting bull market in palladium is setting the stage for a 50% to 100% move in platinum.

The crypto market has quietly recovered after a severe drop during which many mainstream commentators declared “the Death of Bitcoin.” Bitcoin is making higher lows and looks set, from a technical perspective, to rechallenge 2019 highs. Crypto represents another “escape route” from the global fiat monetary system and hard money investors may want to use any weakness in the crypto market as an opportunity to accumulate a crypto inventory.

Anti-Cryptocurrency Sentiment

The tech monopolies have silently declared war on crypto. YouTube recently temporarily demonetized or purged much of the crypto-related content that had been posted on its platform; the Chrome browser recently disabled the Metamask extension, which has served as a critical tool for various crypto and blockchain applications. Google and Facebook inherently want to integrate novel payment layers into operating systems to maximize rent-seeking power, while slowing down the disruptive impact of decentralized fintech innovation represented by crypto and blockchain technology.

The mirror image of this “technology war” is the move against gold by the German government, which just reduced, effective January 1, 2020, the minimum reporting requirement for gold transactions from EUR 10,000 to EUR 2,000. This type of policy reflects the general will of the State to close off any escape from the black hole of negative interest rates and unfettered financial surveillance. Long live monetary sovereignty!

Author: James Passin

Famed “daredevil investor” James Passin, Chartered Market Technician, is Executive Chairman of Block-chain Holdings, Ltd. (symbol BCX on the Canadian Securities Exchange), a public company listed in Canada.

Famed “daredevil investor” James Passin, Chartered Market Technician, is Executive Chairman of Block-chain Holdings, Ltd. (symbol BCX on the Canadian Securities Exchange), a public company listed in Canada.