By Maurice Rosen

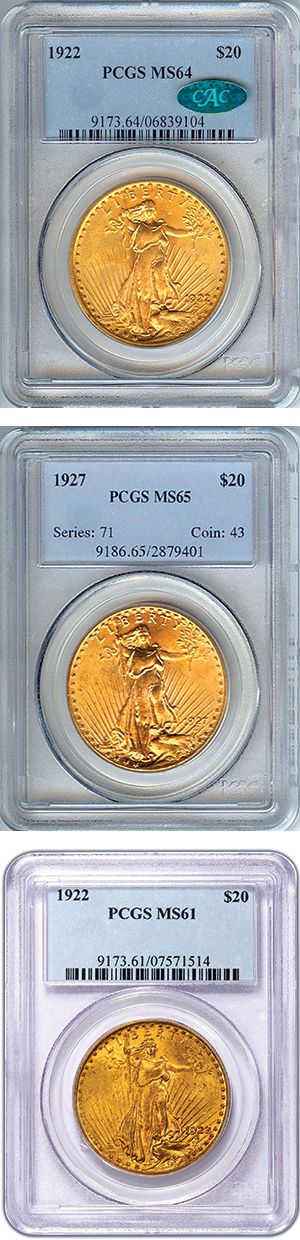

The price of gold reached its historic high in 2011: $1,923 per troy ounce. That price was nearly three times where it was just three years earlier in 2008. Gold coins, such as modern American gold Eagles and vintage Liberty Head and Saint-Gaudens $20 double eagles were in strong demand, reflecting the record high gold prices.

Since then, the gold price has fallen some 40%, to a low of $1,161 in 2018. Clearly, gold turned out to be a lousy investment, unless, of course, you acquired your coins before 2011 at much lower prices.

But besides the very real investment aspects of gold, positive or negative, gold offers another important feature, one that is often overlooked and not widely understood. That is insurance.

Throughout history, there have been times when owning gold was a life-saver for people and their families. There have been many terrible disasters over time, such as wars, depressions, and oppressive governments. I’m not predicting any such tragedy, but to deny that such an event might occur in the future is not a prudent read of history. And who knows what the future can bring should a massive computer meltdown or other technological mishap occur.

Throughout history, there have been times when owning gold was a life-saver for people and their families. There have been many terrible disasters over time, such as wars, depressions, and oppressive governments. I’m not predicting any such tragedy, but to deny that such an event might occur in the future is not a prudent read of history. And who knows what the future can bring should a massive computer meltdown or other technological mishap occur.

The take-away point for us is that we can view gold coins as an insurance holding with a “sometimes investment” kicker. You don’t buy other, more traditional, forms of insurance with the hope of experiencing a loss then making a claim to collect a lot of money.

• Do you want your car to be totaled in a terrible accident?

• Do you want a fire to completely consume your house and all your belongings just because you have homeowner’s insurance?

• Do you want yourself or someone in your family to suffer a dreadful health issue just because you or they have a great health insurance policy?

• And I assume you are certainly in no hurry to have your family make a death claim on your life because you have a fat insurance policy.

As each year goes by without your suffering any of those tragedies, you routinely renew your policies. Why? Because they provide you peace of mind, safety, and the relief of worry. It’s the same with that portion of your total assets that you keep in gold.

Then there’s the happily non-catastrophic example of gold serving as an anchor to a balanced portfolio. Consider how the stock market has been performing since that fateful year for gold in 2011. The major stock averages soared 200% while gold fell by 40%. Expressed in dollar terms, that means every $1,000 invested in stocks rose to $3,000, while the same $1,000 in gold dropped to $600. That’s a difference of five times your money held in stocks rather than gold!

At some point the price of gold will be rising again, perhaps substantially. How high can it go? While I will not make any predictions here, I will relate to you that I have read forecasts from some esteemed and highly followed commentators who are calling for gold prices over the next few year getting well into the five and even six digits.

By the same token, I have also read calls for three-digit gold prices. No matter which way the gold price is destined to go, I anticipate that gold will offer the proven benefits of balancing the risks of one’s overall portfolio.

Sign Up for the FREE COINage Weekly Update!

Stay in the know. Get the latest news and information from COINage delivered

weekly – right to your inbox!

How much gold should you own? While every individual’s circumstances are personal and could vary greatly from others, many professional money managers have an understanding and appreciation for gold serving as a component in their clients’ portfolios to the extent of from 5% to 20%.

Consider that only a very small fraction of 1% of all American families own gold other than jewelry. They are seriously under insured. And now, with the level of interest in gold at record low levels, you can acquire gold at a substantial discount of where it was seven years ago. You should seriously consider adding this insurance policy to your holdings.

Want to receive COINage magazine in your mailbox or inbox? Subscribe today!