By R.W. Julian

For the more than 200 years that the United States mints have been in operation, there have been good and bad years for coinage. These fluctuations have directly affected those dedicated collectors who avidly seek out coins of this country, especially where the output was low in the difficult years.

In the early days of the Philadelphia Mint, especially during the 1790s, coinage was very erratic, as the striking of gold and silver coins depended on bullion brought to the Mint by private depositors. The situation did improve somewhat after 1797 when the Bank of the United States was persuaded to make regular deposits of the precious metals; at first, these were primarily foreign silver coins, especially those of France. In time, however, gold was also sent to the Mint in reasonable amounts.

Minor Silver Coin Mintages

Some of the mintages, such as for the minor silver coins in 1796 and 1797, are very small and costly to modern-day collectors wishing to add to their collections. It is sometimes said that these small coinages were the result of not enough bullion coming to the Mint, but this is only partially correct.

The lack of bullion, especially silver, meant that Mint Director Elias Boudinot had two choices. The first was to lay off skilled workers until the deposits got better. The second was to create a make-work situation in which small coinages, which required time and effort, were the order of the day; in 1796 and 1797, the make-work answer enabled the director to keep skilled workers on hand until bullion deposits increased.

It is also said that the United States Mint at Philadelphia, in its earlier days, was not able to supply sufficient silver and gold coins for the public to use in the marketplace. This fact is again partly correct in that the entire output of the Philadelphia Mint, even including cents and half cents of copper, did not come close to providing a strong circulating medium for the country. We also find numerous instances of small coinages, such as the 1815 half dollar in which less than 50,000 were struck. The charge of not enough coins coming from the Mint is true, but again not quite the whole story.

Spanish Coin Production

In reality, the American marketplace was relatively well supplied with silver and copper coins, the latter, of course, coming from the Mint. The bulk of the silver coins in daily use, however, were not made in the United States but were rather Spanish coins coming from mints in the Americas, especially Mexico City, Lima, and Potosi. After 1821 most of the silver came from newly independent Mexico.

Some idea of the amount of Spanish and Mexican silver in daily use can be seen in a study done in New York City in the late 1830s. At that time, United States coins made up only about one-sixth of the silver in daily use, the rest being foreign. Not all of the foreign was Spanish as there was a small amount of French silver in everyday use, mostly five-franc pieces. Because of this surplus of foreign silver in the marketplace, there was less pressure on the Philadelphia and New Orleans Mints for heavy coinages of silver. The New Orleans Mint coined both silver and gold after it opened for coinage in 1838.

The generally well-stocked marketplace, in terms of available coinage, came crashing to a halt in the late 1840s, the United States now facing its first real monetary problem. The discovery of gold in California in early 1848 and the large quantities found there led to an abundance of gold in the marketplace. The discovery of gold, in turn, meant that silver would rise in value to the point that a half dollar, for example, now contained about 52 cents worth of silver.

This increase in the intrinsic value of the silver coins of the United States made it worthwhile for bullion dealers to buy up all of the silver coins that could be readily found and ship them to Europe at a profit. The silver was purchased with gold, which was easily obtained by the bullion dealers.

The result of the silver being shipped to Europe was a more-or-less sudden decrease in the number of silver coins available to the public. Because bullion dealers bought even the full-weight Spanish and Mexican silver coins, there was little left for the public except for the odd Spanish piece that was worn smooth and of lighter weight; there was no profit in the latter pieces for the bullion dealers.

Public Interest Drives Silver Production

By the latter part of 1850, there were strong public demands for

the government to act in solving the rapidly worsening coin shortage. There was plenty of gold, but it was of little use to the average citizen. Copper coins were in reasonable supply, but silver was hard to find. Moreover, silver was not being brought to the mints, resulting in much lower mintages. These lower mintages were not quite the full story. Bullion dealers managed to obtain a fair amount of the new coins as well for shipping to Europe. The melting of coins, accompanied by the lower mintages, meant that later collectors were faced with increased difficulty in obtaining certain series of coins such as the silver dollar, which had especially small mintages.

For 1851 and 1852, the number of silver dollars in all came to less than 2,500 pieces, making the survivors at the time high-ticket items for serious collectors. Even the 1850 silver dollar, with only 7,500 struck, is beyond the reach of beginning collectors due to the high cost involved.

The problem with low mintage silver dollars is not the only impediment for this period. The smaller silver coins are equally a problem, though not quite as bad as the 1850–1852 silver dollars. The 1852–O (New Orleans) quarter dollar, for example, was struck in only 96,000 pieces, and today a Very Fine specimen is worth well above $1,000.

In early 1851, Congress finally acted by creating a debased silver three-cent piece, often called a “trime” by modern collectors, as well as mint officials in that era. Large numbers of trimes were struck in 1851 and 1852, but this only served to ameliorate the serious coin shortage, not solve it.

A Flood of Silver

During 1851 and extending into early 1853, the nation limped along with the trime, copper coins, and fractional paper currency issued by merchants. At length, in early 1853, Congress passed a comprehensive coinage reform, which lowered the amount of pure silver in the minor coins below one dollar in value. The six percent decrease was enough to keep the coins from being sent abroad, and the very heavy resulting coinage made such pieces readily available, at a reasonable cost, to collectors at the time.

In the spring of 1853, there was a flood of silver coins coming from the mints of Philadelphia and New Orleans, to be joined in 1855 by the newly-opened mint at San Francisco. Because of this heavy coinage, collectors can obtain most dates and mintmarks for silver dating from the 1850s.

There was an odd and unexpected aspect to this new and heavier silver coinage. The 1853 law specified that the minor silver coins were strictly on government account and could be paid out only for gold coins. Congress put this provision into the law so that too many silver coins would not flood the marketplaces. It did not work out quite as planned, however.

Mint Director James Ross Snowden, from his office in the Philadelphia Mint, decided that the law was not exactly to his liking, and the Philadelphia Mint should be striking even more silver coins than was currently the case. In 1854, he announced that he would buy silver bullion with the minor silver coins at a rate in which the government would not lose any money but which would make such coins more readily available to the public.

The public, in fact, like the idea of readily available minor silver coins, and the result was an upsurge of minting such pieces at Philadelphia in 1854 and later years. The mints at New Orleans and San Francisco, however, obeyed the law, and the minor silver coins were paid out only for gold. By 1858, the Eastern Seaboard was well stocked with these silver coins. Today, Philadelphia silver coins from the half dime to the half dollar, are easily acquired for a nominal sum by collectors because of the large numbers struck.

Frustrations Abound

On the other hand, by 1858, banks and merchants were becoming increasingly irritated at the heavy minor silver coinages coming from the Philadelphia Mint. Complaints poured into the Treasury and, at length, Treasury Secretary Howell Cobb ordered Director Snowden to obey the law and pay the silver coins out only for gold. The result was a sudden fall-off of silver coinage, and for 1859 and 1860, the dates are a little more difficult for collectors to obtain. One by-product of the 1853 law, which had been accompanied by further legislation in early 1857, was to drive most of the remaining foreign coins out of domestic circulation. A relatively few number of pieces continued to circulate into the 1870s, but after that, they were virtually never seen in the marketplaces.

The multitude of silver coins available to the public took a sudden turn for the worse in 1861 with the opening cannonades of the Civil War at Charleston, South Carolina. Within days, the nation was at war with itself, as the Southern states seceded from the Union and formed their own government. During most of 1861, as the people in the North and South expected a quick victory for their cause, gold and silver coins remained in daily use in the North; southerners had already hoarded what silver and gold could be found. There was no panic, and life went on as before except for the areas where the fighting was intense.

All of this changed rather dramatically at the end of 1861. The North now joined the South, and every available gold coin was hoarded. The turn of silver came in June 1862, and now there was little or nothing for marketplace needs except for the copper-nickel cents. By now, the South was a strictly paper-money regime, and the North was very close to that point. The situation was different in California, where the San Francisco Mint kept that area well supplied, and there was no panic hoarding of gold or silver coins.

It is for this latter reason that collectors can obtain San Francisco silver coins dating after 1861 much easier than those of Philadelphia. New Orleans no longer counted, as it was part of the Confederacy and struck no coins during the war.

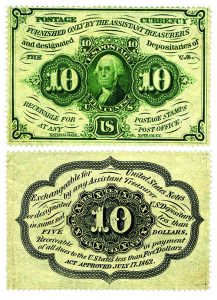

Prevalence of Fractional Paper Currency

By late 1862, the North was almost entirely working with paper. The introduction of fractional paper currency, with values as low as three cents, was the only way in which the marketplaces could operate with any semblance of normality. For those people (east of the Rocky Mountains) who were collecting United States coins during the war, there were difficulties. New coins were no longer available from banks or the Philadelphia Mint. Even the post–1853 silver coins now had a silver content more than face value, meaning that they would not circulate.

The only solution for many collectors was to purchase the annual sets of proof coins. In 1861 one could still buy individual coins, but for 1862, Mint Director James Pollock changed the rules by forcing collectors to buy an entire set of silver or proof coins. This rule change meant that those who specialized in half dollars, for example, had to buy the full set to get just this one coin. Only the cent coins were generally available though this was somewhat of a problem when cents began to be hoarded by the public in late 1862. The cent coin was included in the silver proof set.

The problem was somewhat more complicated than it appeared on the surface. In buying gold or silver proof coins, the collector had to pay in gold or silver, and such coins were not readily available. Sometimes mint officials would permit payment in paper money at the current rate of exchange. A ten-dollar bill, for example, might be worth $8.00 in specie on the open market and be accepted by the Mint at that value.

Challenges of Accessing Minor Silver Coins

The difficulty in obtaining minor silver coins for a collection lasted until the summer of 1873 when the government was finally able to put such coins back into daily use. Until 1877, it was then easy to obtain fresh silver coins from the banks.

The availability of minor silver coins results in another turn for the

worse in 1878. For reasons not fully understood, then or now, there were a large number of United States silver coins that returned from abroad in 1877 and 1878. They had been exported during the Civil War and were now returning. So many came back, in fact, that the Treasury stopped minor silver coinage except for a few thousand each year meant for birthdays and Christmas presents.

During the 1880s, collectors were able to get minor silver coins with some difficulty, but more often than not simply purchased a silver proof set to avoid the time needed to find choice specimens. In 1891, full silver coinage resumed at all mints, and that problem was now over. Since 1891, there have been no major coin shortages, although there was a minor disruption in the mid–the 1960s.

There were generally healthy coinages in the 1920s, but the 1930s and the Great Depression were another matter. Coinage levels dropped somewhat dramatically, but the average collector still had a little problem obtaining new silver coins. The rise in the value of silver in the early 1960s forced the government to switch to a copper–nickel composition for the dimes and quarters. Half dollars, for political reasons (the Kennedy design), were given a limited silver content of 40 percent.

During 1964 and 1965, banks limited the amount of silver coins paid out, but there was little real disruption of the economy. By late 1965, there was a flood of the “sandwich” dimes, quarters, and half dollars, and since that time, there has been no shortage of coins for the marketplace or collectors.