By Josh McMorrow-Hernandez

There’s an eerie silence in the world these days.

Humankind is hibernating, waiting until it’s safe to come back out again. To return to a life we once knew but will never quite be the same again. It’s a society transformed by the COVID-19 (or coronavirus) pandemic, a killer that emerged from Asia in late 2019 and quickly swept around the world in a matter of weeks.

This virus is unlike any other we’ve seen since 1918, when the Spanish Flu killed over 50 million people over two years and extinguished the lives of more people than were lost in all of World War I, which ended just as the flu began overwhelming the globe.

Today, we face another pandemic, one that by the time this article has reached readers will surely have already reached millions of lives. Or, maybe, will be reaching an apex. What we do know about this pandemic is that it is unpredictable. It’s easily transmissible, can be carried in otherwise healthy people without presenting one outward symptom, and may incubate for 14 days – enough time for an unsuspecting carrier to infect a lot of people. Because of those dangerous wildcards, the United States, along with many other nations around the world, has put a temporary pause on everyday life.

Consistency of Change

No more concerts. No more dining at restaurants. No more shopping at the mall. No more houses of worship. Travel bans and local lockdowns have become a way of life for many. Work must be done from home whenever possible. Disney World in Florida and Disneyland in California shuttered their doors for many weeks. The world of sports has been put on hold, with many leagues calling their season over prematurely or canceled altogether.

Collectibles Expo grappled with going ahead with the show before a lockdown was established. This photo is from

an earlier Expo. JOSHUA MCMORROW-HERNANDEZ

Even Wimbledon was canceled. The virus has touched countless lives – many whom we know of, too. Testing positive for the coronavirus are Britain’s Prince Charles, United Kingdom’s Prime Minister Boris Johnson, actor Tom Hanks and his singer-songwriter wife Rita Wilson, Spanish opera singer Placido Domingo, and rocker Jackson Browne, among other notables. It has also killed a number of celebrities, too, including country music star Joe Diffie, African jazz artist Manu Dibango, CBS news journalist Maria Mercader, actor Mark Blum, and playwright Terrence McNally.

COVID-19 has also taken the lives of people in the numismatic community. Prominent New York coin collector, prolific numismatic author, coin organization officer, and ophthalmic surgeon, Dr. Jay M. Galst, succumbed to the virus on April 11. An earlier United States death related to the virus was that of a prominent 71-year-old California coin dealer whose name is being withheld at the request of his family and friends.

Photographer Todd Pollock regarded the unnamed dealer as a mentor. “I had been going to this shop since I was 12. I could not believe the dealer has passed under these circumstances. He came to my high school graduation party and college graduation party and had become a family friend.”

Pollock, who owns numismatic photography firm BluCC and runs his business in Sacramento, California, says he owes his career, a hybrid of coin dealing and photographing coins, to this dealer, too. “Without this dealer I would likely not be dealing and photographing coins. At a young age he treated me right.” He remarks, “I still have an A-mark round I bought from him when I was around 12 […] and a ‘rattler’ 1880-S Morgan dollar with some color that is the longest-owned piece for my set of slabbed coins in my collection.” He was a close friend of the family, too. “In more recent years my dad saw him much more than me for lunches on occasion. They were two peas in a pod, and I know he is shocked by the news also.”

The passing of Pollock’s dear friend puts a human face on the pandemic for us in the numismatic community. Ours is an industry that never seems to stop moving. But, for COVID-19, we have. And we have in ways that we probably could not have imagined a year ago. Coin clubs have stopped meetings. Coin shows have been canceled. Coin auction firms moved events slated for the floor to online virtual spaces. Stack’s Bowers Galleries, one of the biggest firms to have hosted an event affected by coronavirus up to the time of this writing, had to move a major auction event slated for the Spring Whitman Coin & Collectibles Expo from Baltimore, Maryland, to the auction house’s headquarters in Santa Ana, California.

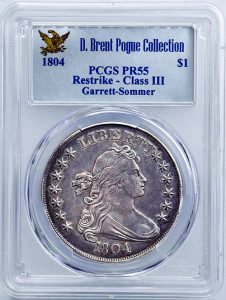

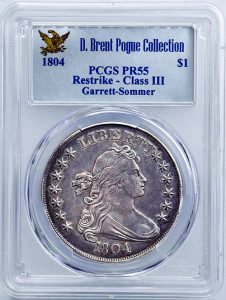

Its March 2020 auction, which included many noteworthy lots – including a Class III 1804 Draped Bust dollar and 1854-S Liberty Head half eagle, was relocated when the show it was going to headline, the Spring Whitman Coin & Collectibles Expo in Baltimore, was canceled. Stack’s Bowers Galleries still managed a successful auction, as is reported by Greg Reynolds, beginning on page 56, of this issue of COINage. Among the highlights were a Proof-55 1804 Draped Bust dollar and AU58+ 1854-S Liberty half eagle with Certified Acceptance Corporation sticker taking $1.44 million and $1.92 million, respectively. The sale of both coins, graded by Professional Coin Grading Service, was much anticipated throughout many corners of the numismatic community. But, so, too, on everybody’s numismatic calendars was the Spring Whitman Expo, an event that ushers in the throng of mid-year coin shows.

Show Assessment and Strategizing

There was collective understanding from many dealers and collectors

Class III Restrike, from the legendary D. Brent Pogue Collection, brought $1.44M

during Stack’s Bowers March 2020 auction. STACK’S BOWERS

when they heard the news that the Whitman Spring Expo, slated for March 19-21, was canceled. “We’ve received only positive feedback about the decision,” says General Manager of Whitman Coin and Collectibles Expos Lori Kraft.

“Dealers and collectors were equally concerned about their health and wellbeing and have showed great appreciation for us taking the time to evaluate all the factors prior to canceling. Our dealers really rallied behind us believing and trusting that we would make the correct decision,” she remarks. “Everyone has been extremely understanding and supportive.”

Of course, it’s not easy making a decision to cancel a major event like the Spring Whitman Expo, one of the largest events on the spring numismatic calendar. “There were many factors that had to be considered prior to canceling,” explains Kraft. “The first of course was the health and wellbeing of our dealers and attendees. The COVID-19 novel coronavirus situation was so rapidly evolving that at times it had changed before we had even hung up the phone or finished reading an article.”

Another challenge? Keeping up with the crisis on the ground in Baltimore. “We were constantly checking in with Visit Baltimore, The Baltimore Convention Center, the Centers for Disease Control and Prevention (CDC), and the World Health Organization (WHO) regarding the COVID-19 activity both locally in Baltimore as well as nationwide, which led to another factor of consideration. We understood the financial importance that the Whitman Expo would provide to the dealer and collector community so our decision would be made with all these factors being considered.”

The final straw was an announcement from Maryland’s governor. “When Governor Larry Hogan stated that there could be no gatherings over 250 people, we knew the correct decision was to immediately cancel the Whitman Expo bourse activity.” Kraft and her team at Whitman Coin & Collectibles Expos also were in close touch with Stack’s Bowers Galleries to devise a plan for the show’s headlining auction. “We stayed in constant contact with President of Stack’s Bowers Galleries Brian Kendrella and collectively considered and developed a strategy that would be best for the health and wellbeing of our dealers and attendees.”

Kraft, noting the COVID-19 pandemic and its effects on the numismatic hobby is unlike anything seen before, said show coordinators must deal with situations like this by considering multiple facets. “As promoters, we have to be understanding and supportive to multiple industries and individuals, such as tourism and travel, hospitality, vendors, venues, unions, dealers, exhibitors, attendees and the list goes on.” For now, she adds, it’s a waiting game as the numismatic community determines the next steps in the coming weeks and months.

She also looks on the bright side, confident that when the time comes when it’s safe for crowds to gather again and coin shows are once again playing out across the country that bourse floor activity will be especially vibrant. “Many will be stir-crazed from being inside and desperate for face-to-face conversation after practicing social distancing.” Being cooped up for weeks at a time may have an additional positive impact for our hobby. “Perhaps many adults are sitting down with their children, cracking open a ‘Red Book,’ and have started going through that coin jar that they had been filling for years. Parents are likely going through their collections now with their children and creating excitement for the hobby.”

Class III Restrike, from the legendary D. Brent Pogue Collection, brought $1.44M

during Stack’s Bowers March 2020 auction. STACK’S BOWERS

While national shows such as the Whitman Expo are on hold, so, too, are regional and state-level shows. Central States Numismatic Society (CSNS) Convention Chairman Kevin Foley had been monitoring the coronavirus emergency for weeks before canceling the 81st Annual Central States Numismatic Convention, which was to be held April 22-25. “It was with great reluctance that we canceled the CSNS convention.” The domino effect of event closures happening throughout the nation was a determining factor. “We [canceled] in the immediate wake of the closure order imposed on conventions and gatherings of our size by the Governor of Maryland that directly impacted the Whitman Baltimore Expo. A similar order was soon thereafter issued by Governor [Jay] Pritzker for Illinois.”

As the Whitman Expo organization was faced with the cancelation of their convention in Baltimore, Foley said there was a constellation of matters to consider when nixing the next CSNS show. “As we considered our options in light of our responsibility to our booth holders and attendees – both our economic responsibility as well as our health and welfare responsibility – it became increasingly apparent almost with each passing hour as events unfolded that it would literally be impossible to continue. In effect, reality made our decision for us.”

Within days of Foley and the CSNS announcing their decision, the CDC issued recommendations that groups of no more than 50 people convene in any one location for at least the next eight weeks. “During this same period Dr. Anthony Fauci, one of the most respected members of the public health community, issued a series of statements highlighting the underlying gravity of the threat posed by this, with the World Health Organization declaring COVID-19 a pandemic. In light of the foregoing we simply had to accept the fact that it would have been irresponsible to hold our event under the current clearly worsening circumstances.”

While the pandemic affected springtime coin shows, it’s unclear what the status of the virus will be during the warmer summer months in places like Florida, where the Florida United Numismatists (FUN) holds its popular Summer FUN Show in July, an event complementing the organization’s much larger annual convention in January. FUN Show Secretary and Show Coordinator Cindy Wibker said she has been in a “holding pattern” on whether the 2020 Summer FUN Show was going to be held this year on its long-planned July 9-11, 2020 dates. It’s a decision that would be made at the organization’s next board meeting in mid-April, after this issue of COINage went to press.

“I think the biggest factor to consider is whether the virus is spreading or being contained,” she remarks. “The next several weeks will be crucial for making a decision on the Summer FUN Show.” She noted four major conferences were canceled in Orlando, the Central Florida city that would host the 2020 Summer FUN Show. “Public fear will play a big role in our decision.” If the 2020 Summer FUN Show does go on, Wibker says attendees can expect to see hand sanitizer available “in abundance” to the extent logistically possible. “I’m confident the Orange County Convention Center, where the show is slated to be held, and the local hotels will have special precautions in place.”

Wibker says the response to COVID-19 is unlike anything she’s seen during her many decades in the hobby. Nor can she recall FUN being faced with such decisions during past pandemics. “I don’t have any memory of us having to deal with other epidemics in the past, though perhaps the time of year those epidemics were a health concern didn’t affect our show dates.”

Meanwhile, the American Numismatic Association (ANA) announced it would cancel its popular Summer Seminar educational program, slated for June 27 through July 9 in Colorado Springs, Colorado. “While it seemed inevitable with each passing week, we were officially notified by Colorado College on April 8 that they are suspending all summer programs in order to ‘restrict participants who have traveled to or from affected areas’ associated with the pandemic,” ANA Executive Director Kim Kiick said in a statement about the first cancelation of the Summer Seminar in its 50-year history.

Coin Clubs Get Creative

Local-level clubs are also not immune to the closures and cancelations related to the coronavirus. Citrus County Coin Club President Bob Bandino says his Florida club, primarily serving communities about one hour north of Tampa, was already taking extra precautions during meetings before the onset of social distancing and widespread event cancelations. “We talked with the facility owners and were told the building had been extra-cleaned and wiped down, all tables and chairs were cleaned, etc.,” says Bandino. “Normally we have fresh fruit on a table – grapes, strawberries, and watermelon cut in pieces. The last meeting, candy bars and granola were [in] factory-sealed packages – no open food.”

But as the COVID-19 pandemic started hitting closer to home by mid-March, Bandino and the board of the club, founded only in late 2019, decided to think outside the box by hosting virtual club meetings, the first of which was held April 21 in lieu of their regular in-person meeting – they even had a virtual presentation on Eisenhower dollars. “This could be a model for our club and others well after the COVID pandemic is over. It can help bring members back who can’t attend in-person meetings anymore due to personal illnesses or other situations and to also bring new people in who don’t necessarily want to meet at a physical location but still want to be a member.” He says the club is now determining the most efficient way to host virtual auctions during their future online coin club meetings, too.

Movement in the Marketplace

While coin clubs and coin shows adjust to the socioeconomic effects of the coronavirus, coin dealers are staying as busy as ever. Some of the marketplace activity is driven by more people staying at home and turning to numismatics – either for the first time in their lives or on a return trip to the hobby after years away from collecting coins. But much of the marketplace buzz is also building due to increased interest in bullion.

Precious metals, gold and silver particularly, have seen a major increase in demand as more investors look for a safe haven following the unforeseen stock market crash coinciding with the COVID-19 pandemic and an unrelated oil price war between Saudi Arabia and Russia.

The Dow Jones Industrial Average closed at a record high on February 12, 2020, charting at 29,551.42 points. Then the bottom fell out. The Dow shed more than 35% of its volume in six weeks, dropping to 18,213.65 points on March 23 after posting some of the worst single-day losses ever seen. To help boost the economy, the Federal Reserve cut interest rates to 0% and United States Congress passed a $2 trillion economic stimulus package, signed into law by President Donald Trump, to help provide support for workers who are out of their jobs due to widespread closures of everything from theme parks and hotels to shopping malls and restaurants.

President Trump invoked the Defense Production Act to require companies like General Motors to produce hospital ventilators and other medical necessities. And as medical facilities run low on basic necessities such as gloves and masks, grocery stores are depleted of toilet paper, hand sanitizer, and other daily staples. All of this impact has prompted more and more investors to turn to gold and silver, and even bullion supplies are running low.

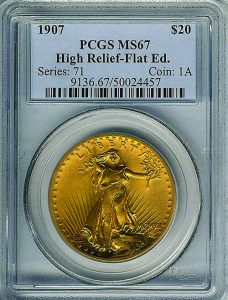

“Very little is available in physical [bullion], except perhaps some odd-weight gold coins and bars right now,” says Brian Kuszmar of Commercial Rare Coins and Precious Metals in Lauderdale-By-The-Sea, Florida. “I’d bet you’d be lucky to find 100 About Uncirculated-Brilliant Uncirculated Liberty or Saint-Gaudens $20s for much less than American Gold Eagle premiums. I just barely filled an order of 500 one-ounce bars from my refiner – lucky we got it. All Swiss refiners are closed, and they’re a minimum four weeks out – when they reopen – on new products, and that’s highly unlikely.” He says silver is also scarce. “It’s been sucked dry.”

Former APMEX Vice President Michael Garofalo has seen a lot in his 40-plus years as a coin dealer. He weathered the bullion boom-bust cycle of 1979-81, the stock market crash of 1987, the collapse of the coin market in 1989, the 9/11 terror attacks in 2001, and the Great Recession that began in 2007 and caused ripple effects for years afterward. He has also seen his share of flu pandemics over those years. But none of them, he says, has caused the impact that the coronavirus has had on the numismatic industry or the bullion market in general. “Compared to today’s coronavirus, prior outbreaks were minor in comparison in relation to their impact on financial markets.”

He believes a variety of issues are compounding the situation this time. “There’s anger at the United States government for not being fully prepared for this virus, air travel is down, hotel reservations are down, tourism is down – all affecting the economy. Then there is the oil war that Saudi Arabia is waging against the world and how the glut of oil today is dropping prices and depressing economies around the world.”

While the economic response to this virus is unprecedented in the context of past economic troubles with other pandemics, Garofalo is not surprised to see investors cling to precious metals in a time like this. “During prior disasters, investors have always flocked to gold as their hedge in uncertain times, but not to the degree that they are doing it today.” He says this may have something to do with the way people can trade both stocks and bullion with the simple click of a button on a mobile device from virtually anywhere.

Golden Popularity

But why is gold in particular so popular? “Many investors like the idea of having an asset that usually has a negative correlation to the stock market,” he explains.

“What I mean is that generally when the stock market goes down, historically, gold prices go up. In times of financial uncertainty, many investors flock to gold – it has been a store of value for over 5,000 years.” Garofalo says other key advantages to owning gold is that it’s private and not tracked, is portable, easy to buy and own, and can be transferred from one generation to the next.

Of course, gold comes in many forms – including vintage gold and  modern bullion coins. He says both are popular with investors, though price largely drives the decision as to which the buyer chooses. “Among the advantages of modern bullion coins is that they are usually denominated in troy ounces or fractions thereof – 1/20th of an ounce, 1/10th, 1/4, 1/2, etc. – so knowing exactly how much gold you have to sell or that you can buy is pretty easy to calculate. But one downside is that with many modern issues investors often have no track of buying these items and they do not know if their premiums will hold up when the time comes to sell them.”

modern bullion coins. He says both are popular with investors, though price largely drives the decision as to which the buyer chooses. “Among the advantages of modern bullion coins is that they are usually denominated in troy ounces or fractions thereof – 1/20th of an ounce, 1/10th, 1/4, 1/2, etc. – so knowing exactly how much gold you have to sell or that you can buy is pretty easy to calculate. But one downside is that with many modern issues investors often have no track of buying these items and they do not know if their premiums will hold up when the time comes to sell them.”

Vintage coins also have their pros and cons. “One disadvantage is that the older gold coins have strange and unusual amounts of pure gold, but there is a familiarity with them that offsets it to a degree.” For example, a British sovereign contains .2354 ounces of gold and its purity is .9167. “Although you need a calculator to figure out exactly how much gold you have, there is strong market demand for these coins that have been the bellwether coins in the marketplace for over two centuries.”

John Albanese, who has spent more than 40 years in numismatics as a coin dealer, cofounded Professional Coin Grading Service, founded Numismatic Guaranty Corporation, and established Certified Acceptance Corporation, says those who are buying coins now are snapping up common-date pre-1933 United States gold coins with low numismatic premiums. “You can buy a 140-year-old uncirculated gold coin of limited mintage for less money over spot than you can a modern American Gold Eagle. And with the vintage coins you have fantastic crossover appeal with both bullion buyers and numismatic collectors.”

Meanwhile, Albanese refers to the bullion market as having been “herky jerky” lately, with investors hoping they’re buying the right metals and at the right amounts for decent appreciation. “A lot of sophisticated investors who I know believe that silver and gold will do well because the way out of the coronavirus issue from the economic standpoint is for the Fed to do QE [quantitative easing, a process in which the Fed buys bonds and other assets to infuse money into the markets] and to print more money to stimulate the economy, and that’s usually good for gold. It’s sort of a mixed bag here.”

As for collectors, they continue buying coins – for now. “But this is uncharted territory,” states Albanese. “In 2008 and ’09, gold coins had a very good run, and even numismatic rarities held up very well, considering all the wealth that disappeared in the stock market,” he recalls.

At Certified Acceptance Corporation, Albanese gets a daily front-row seat in the coin marketplace as he receives thousands of submissions of certified coinage – many pieces high end – and determines whether or not they qualify for a small bean-shaped label he affixes on the slabs of coins that represents the finest quality for their labeled grade. So, he’s curious what the flow of coins will be like in the days ahead as the economy further responds to coronavirus.

He thinks hobbyists in the lower economic rungs of the market will continue buying coins and building sets. “But for the more expensive coins, it’s a little different. The stock market has a bigger impact on the larger collectors who want to buy six- or seven-figure coins,” he remarks. “And with the stock market plunge, when it comes to expensive coins, we need to take a wait-and-see approach.”

Albanese says the coin market was resilient in the wake of the Great Recession in 2008 and 2009. “But we’ll see here. I think people have other things on their minds right now than buying coins.” Priorities have shifted, he says, even for the most ardent of coin collectors. “They want to buy supplies and check up on neighbors and their elderly parents. We didn’t have these concerns in 2008 and ’09 – we were worried about our financial health, not our physical health.” He adds, “Now we’re worried about both.”

For now, people are staying at home or going home so they can try to make the best of the situation. Once-high-flying Ohio professional numismatist and former Republican political operative, Thomas W. Noe, imprisoned for stealing from Ohio’s $50 million coin fund, may be going home early. Ohio Gov. Mike DeWine recommended Noe for release based on the coronavirus risk.

Regardless, as a collective we truly do have one thing in common: unexpected unplanned time. Albanese concluded: “There’s a lot of talk about binging on Netflix and that type of thing. So if you’re a hobbyist and want to complete your Indian Head cent collection, why not do it now? You’ve got some spare time.”