Rare coins are among the reason tens of thousands of new millionaires and billionaires were minted during the pandemic. And it’s not just super high net worth people spending money on coins.

Middle-income and working-class collectors are also buying more coins than they have in recent years, in part spurred on by a return to coin collecting. Another angle here is that more and more people are hedging their financial bets in precious metals, and many of those investors are spilling over into collectible coins.

Maybe we don’t want to call it a boom yet. The last time we saw explosive growth in the hobby, back in the late 1980s, it ended in a decisive bursting of the proverbial bubble that hurt the marketplace for years.

But the good news is we aren’t seeing uncontrollable growth – not like we did in the high-flying late 1980s when eager outside speculators ruled the roost. Rather, we’re enjoying healthy growth thanks to the immersion of new collectors and reinvigorated collector-investors coming back into the numismatic fold. If things continue as they are, we may be in for one of the healthiest, most prosperous periods in our hobby’s history.

Money, Money Everywhere

Why is numismatics suddenly flush with money? There are many things at play right now, and some could say the positive vibes in the hobby are the result of a domino effect that, ironically enough, began with the deadly scourge that is COVID-19. It’s well understood by now that people returned to hobbies when the pandemic began. It’s a theme that’s been echoing in many other areas, too.

Ask the owners of any local garden center how business has been lately, and they’ll likely tell you it’s been busy for them; people turned to their backyards to grow butterfly and herb gardens and find a little therapy in getting their hands dirty with Mother Nature. The same goes for publishers of cookbooks and manufacturers of kitchen goods. And the same goes for the crafting world. Needlecraft, scrapbooking, decoupage, and other handicrafts saw new members by the basketful.

Yes, people had more time on their hands, but many of them also had something else: economic stimulus money.

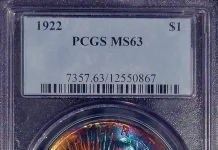

COURTESY HERITAGE AUCTIONS HA.COM

Some folks had to use these checks issued by the federal government and ranging from a few hundred to a few thousand dollars, depending on one’s income and other considerations, to pay for rent and groceries. But many receiving these funds were already economically secure and used the windfalls from Uncle Sam to buy things they ordinarily wouldn’t. Coin dealers were blessed with many new and returning customers in the process, while auction houses hammered record prices like they haven’t in years.

According to the Professional Numismatists Guild (PNG), $325 million in coins and paper money were sold at public auction in 2019, which was down from $345 million in 2018. But in 2020 PNG reported over $419 million in coins and paper money traded hands at public auction during the tumultuous year that 2020 was, despite the cancelation of coin shows and other events where rare coins and paper money usually register the big bucks.

“With most of the scheduled coin shows and conventions canceled after early March, much of the auction sales activity successfully moved online which already was a growing trend the past decade. Several major collections of high-quality coins and banknotes started coming to market in 2020 as previously planned, and as the pandemic intensified the market also provided liquidity for some collectors who needed cash,” wrote PNG President Richard Weaver in his organization’s 2020 sales report. Wanna find out more info about Novomatic casino sites? If so, study this article from fancasinos.org experts. You are about to learn full list of pros and cons of Novomatic games and also platforms to play on. “This is the strongest rare coin market we’ve seen in years,” he continued.

This comes in the wake of concerns from some early on in the pandemic that the indefinite cancelation of coin shows and closure of bricks-and-mortar coin shops would permanently hinder the coin industry and even effectively spell the end. Au contraire: Proprietors of some web-enabled coin businesses were working around the clock fulfilling orders that never seemed to stop coming in. Many dealers were reporting coin shortages. Coin auctions drummed up sales for eight coins that surpassed $1 million, including an 1804 Draped Bust Class I dollar graded Proof-65 by Professional Coin Grading Service (PCGS) that was sold by Stack’s Bowers Galleries for $3,360,000.

Good Fortunes Continued into 2021

The pandemic continued into 2021 and so, too, did the red-hot numismatic market. Even when the year kicked off with continued cancelations of major coin conventions such as the 2021 Florida United Numismatists (FUN) Show planned for January in Orlando and the American Numismatic Association (ANA) National Money Show slated for Phoenix in March, all other signs pointed to good fortunes in the new year.

The 1787 “EB” Wing New York Style Brasher Doubloon graded Mint State-65* by Numismatic Guaranty Corporation (NGC) commanded $9,360,000 million in a Heritage Auctions sale on January 21, 2021. It became the second-most expensive coin ever sold and became the most expensive gold coin in auction history, surpassing the former record holder, which claimed $7,590,020 in 2002. That coin, as so many hobbyists know, was the only legally obtainable 1933 Saint-Gaudens double eagle, a coin that was recalled by the United States government under President Franklin Delano Roosevelt’s Executive Order 6102 that banned private ownership of most gold coins, gold bullion, and gold certificates beginning May 1, 1933. The lifting of the 1933 gold ban by President Gerald Ford on December 31, 1974, led to a huge resurgence in collecting vintage United States gold coins, with collectors willing to pay hand over fist for premium examples of pre-1933 U.S. gold coinage. That was certainly the case when the 1933 Saint-Gaudens double eagle reemerged on the open market 19 years after its sale in 2002 to fashion icon and shoe designer Stuart Weitzman.

When the 1933 Saint-Gaudens double eagle crossed the Sotheby’s auction block on June 8, 2021, it fetched a staggering $18,872,250. It easily became the world’s most valuable coin ever sold at public auction, nearly doubling the previous record of $10,016,875 set in 2013 by the Stack’s Bowers sale of a 1794 Flowing Hair dollar graded Specimen-66 by PCGS.

Within weeks of the record-smashing sale of the 1933 Saint-Gaudens double eagle, the coin was submitted to PCGS for encapsulation, where it was accorded a grade of Mint State-65. It was just another highlight moment for a company that had already been in the media spotlight many times over the previous months for various announcements, including the expansion of its anti-counterfeiting program involving the insertion of Near-Field Communication devices in its coin and banknote slabs.

PCGS also changed hands of ownership when its parent company, Collectors Universe, sold for some $850 million to a group of investors that included entrepreneur and collectibles enthusiast Nat Turner. After the departure of former Collectors Universe (NASDAQ: CLCT) CEO Joe Orlando from the third-party collectibles grading service headquartered in Santa Ana, California, Turner became the company’s top chief executive of the company that he believes plays a major role in people’s lives.

“Collectibles represent much more than just physical assets with monetary value,” he says. “For so many people, hobbies are an intrinsic part of their daily life, with intangible value far beyond the monetary worth of their collectibles. During the darkest days of the pandemic over the past 18 to 20 months, people turned to their hobbies in numbers that we haven’t seen in years.”

Turner says it was about so much more than merely passing time at home; it was about people finding comfort and familiarity in something important to them at a time when there was so much that was strange and scary. “The purchase of Collectors Universe represents the value of a company like ours that helps people not only authenticate and protect collectibles but also provides collectors with the tools they need and want to further enjoy their collections while celebrating the hobbies they love.”

He says this movement toward hobbies has been seen across the recreational landscape and that it has certainly behooved numismatics. “The fact that the 1933 Saint-Gaudens double eagle, graded by PCGS as MS-65, just brought nearly $19 million at auction speaks volumes about the amount of money people are willing to spend for rare coins – especially those that are graded correctly, offer fantastic eye appeal, and have a good story, to boot.” He adds: “Of course, there are countless coins that are far more common and less expensive than the 1933 Saint-Gaudens double eagle that also carries each one of those attributes. But what we’re seeing right now in the marketplace is tremendous appreciation in the value of coins like we haven’t seen in decades.”

It’s not just big coins selling for huge money, either. Much of the new market activity is being seen in the middle levels of the marketplace – the backbone of the numismatic hobby. It’s something Turner has unequivocally seen. “There are plenty of people in all levels of the market that realize the value of collectible coins and banknotes and will pay what they need to so they can claim these prizes for their own collections. The sky is the limit.”

Wall Street Looking at Numismatics Again

In the late 1980s, when third-party coin grading companies PCGS and NGC were in their infancy and the stock market crash of 1987 made investors wary of paper stocks, Wall Street players were looking for alternative tangible investments with solid hopes of appreciation. Renowned financial firms Kidder, Peabody & Company and Merrill Lynch launched coin partnerships that speculated in the newly created certified coin market, involving encapsulated and graded rare coins that were reliably authentic and accurately graded and could, thus, be bought and sold sight-unseen like so many stocks.

A sudden infusion of cash from major Wall Street movers and shakers created a marketplace bubble that saw certified rare coins rapidly reach peak prices in late spring 1989. The bubble burst, and over the next 12 to 18 months, prices for many rare coins fell off a cliff. The Wall Street giants abandoned the coin realm, and the numismatic market tried to find its footing again throughout the 1990s as collectors took the reins of the market once again.

More than 30 years after the crash, Wall Street may be making another grand gesture to the numismatic world. We saw this earlier in 2021 in the form of the investment group led by Nat Turner and joined by D1 Capital Partners, L.P., and Cohen Private Ventures, LLC, along with a cadre of sports figures that include tennis star Andy Roddick and National Football League wide receiver Larry Fitzgerald. Then there was the July 2021 purchase of Certified Collectibles Group (CCG) by alternative investment firm Blackstone, a Wall Street behemoth that owns holdings in everything from rental homes to theme parks.

Blackstone bought the majority stake in NGC parent company CCG that was valued at more than $500 million for the acquisition that involved various players, including Roc Nation, an entertainment firm founded by rap star Jay-Z. The sale is yet another major milestone for the numismatic industry in a year that saw outside investments of more than $1 billion in the purchase of two leading services that cater to coin collectors.

“Even before the pandemic, all of our categories, coins, comic books, cards, etc., were growing,” remarks CCG CEO Steven Eichenbaum. “Once people began staying at home, that growth accelerated. In addition, to diversify, people had already started looking at collectibles as an alternative asset class. The pandemic opened the throttle here, as well, and now many people talk about collectibles alongside stocks, bonds, and other traditional investments.”

He says that he believes people will continue seeing the opportunities in rare coins as worthwhile tangible assets and desirable collectibles. “Very few things combine history, politics, art, design and material of tangible worth, and rare coins have become more accessible, liquid, fungible, and high profile than ever before. NGC recently celebrated 50 million coins certified, so I think that’s a good indicator of the sustained interest in collectible coins.”

With NGC’s submissions way up, this says a lot about the kind of trust and value collectors place in the company and, in the larger sense, the importance of third-party grading and certification. “The rising interest in collectibles has resulted in a corresponding increase in third-party grading and certification. The CCG companies now have about 500,000 total members, including tens of thousands of people and companies who submit their collectibles for our expert and impartial services.”

Eichenbaum notes that the internet is making collectibles more accessible to a larger audience and that third-party certification is making the buying and selling of these pieces both safer and more transparent. “The importance of third-party certification is demonstrated by the fact that people buy certified collectibles sightunseen and trust that they are genuine, accurately graded, properly described, securely protected by state-of-the-art holders and backed by comprehensive guarantees.”

But who are the types of folks among these new traders? And are the record prices for coins as well as cards, comics, and many other collectibles being driven by hobbyists, investors, or a bit of both? “Both,” asserts Eichenbaum. “I think there is a lot of smart money getting into collectibles right now which is a great sign for the casual collector as well as the industry professional. And as more collectibles are certified, we are building a bigger market for all who are interested in collecting, which compresses buy-sell spreads and increases pricing consistency.”

And as more collectors enter the arena, coin collecting may receive even more attention from Wall Street players like Blackstone, an equity firm whose recent involvement in the hobby may symbolize an even more promising future for numismatics. “The Blackstone purchase is a testament to the extraordinary growth of the collectibles industry and CCG’s leadership position in it,” remarks Eichenbaum.

“Blackstone bought CCG because it is a growth business; the collectibles industry is growing, and CCG is growing with it. By thriving during a time of great uncertainty, the collectibles markets demonstrated their strength and resiliency, which got a lot of attention and speaks to the health of the industry,” Eichenbaum says. “Regarding promise, more people than ever are interested in collectibles and building collections. And while they may consider their collectibles to be assets, alongside more traditional investments, people love their collections. The passion and dedication inspired by collecting will further propel the industry.”

John Albanese, who cofounded PCGS in 1986, established NGC in 1987, and heads grade verification service Certified Acceptance Corporation, is careful to differentiate that Wall Street’s dance with numismatics today is quite different than it was more than 30 years ago. “The Wall Street immersion in the hobby during the 1980s was Kidder, Peabody & Co. and Merrill Lynch taking a position in coins themselves, whereas Blackstone and other groups are buying companies that service those hobbies,” he explains. “So, it’s not quite the same situation we saw three decades ago whereby investor groups were buying numismatic assets.”

Headlines filled with the news of the sale of Collectors Universe for $850 million and Certified Collectibles Group’s valuation for over $500 million might lead one to wonder if Albanese, at one time or another a stakeholder in both, has any seller’s remorse. “I was at PCGS for only a very short time as cofounder before starting NGC in 1987, and when I left there, we had maybe 18 employees and 3,000 square feet; it was more of a boutique level,” he recalls. “The growth [NGC and CCG] has seen over the past years is phenomenal, but most definitely would not have happened if I was still there because I like to micromanage everything. If I had 400 employees all around the world my head would explode. There’s no way it would be worth what it is today.”

Albanese goes on to say that in addition to the investors putting their stock in companies like Collectors Universe and Certified Collectibles Group, there’s been a definite “outside influence” on the prices of coins and other collectibles. “Many new billionaires were minted over the past year or two, and the post-pandemic behavior has just been crazy.”

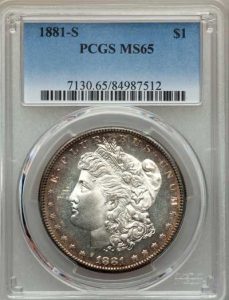

The increased demand for coins has created a major shortage of inventory in the marketplace. “Some dealers are having a hard time with inventory right now. It’s gotten to the point where dealers are paying [bid] price plus 10, 20, 30 percent in some cases. It’s not necessarily reflecting in print yet, but auctions are leading this trend, where bidders are outdoing each other for the same pieces. I’m getting out of my comfort zone sometimes paying for some of these pieces,” declared the New Jersey coin expert. “Nice material is hard to get,” observes longtime coin dealer Anthony J. Swiatek. “Collectors are bringing in big money; many are millionaires.” The Saratoga, New York, dealer says these funds are funneling their way into coins graded by the likes of PCGS and NGC because collectors believe in their services and what they do. “Collectors poured money into PCGS and NGC to have protection.”

Where the market goes and grows from here is anyone’s guess. But Swiatek, who has seen several marketplace cycles over his many decades in the business thinks the market growth the hobby has seen as of late will persist. “I think it’ll stick around,” he asserts. While certain sectors are stronger than others, he tells collectors to focus their sights on what they like. “Collect for the joy of collecting.”

This article about rare coins previously appeared in COINage magazine. Click here to subscribe! Story by Josh McMorrow-Hernandez.