By James Passin

The gold market is now breaking down. It is impossible to settle COMEX gold futures trades as dealers are unable to secure or transport suitable gold bars to settle against the contracts. While the collapse in air travel is playing a role in the disruption to the gold market, I would argue that the entire leveraged financial apparatus that has manipulated the gold futures markets for decades is unraveling.

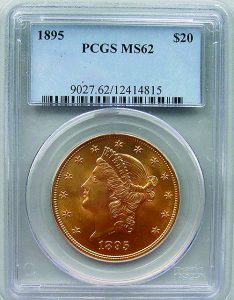

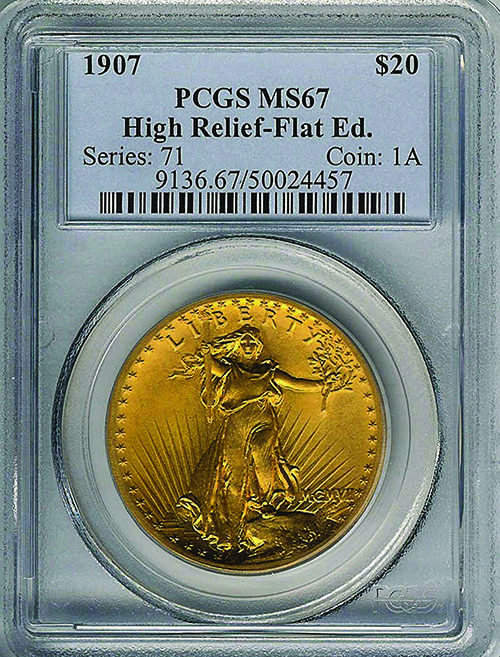

The ultimate protection is to hold your own gold physically and not rely on “paper gold” such as ETFs, gold stocks, gold futures, or gold OTC derivatives. The safest way to buy physical gold is to buy gold coins that are certified by a reputable coin grading service, such as PCGS or NGC. I predict that the Premium Over Melt will blow out over the course of 2020, as the true magnitude of the crisis continues to unfold

Unanticipated Impacts

One of the unexpected consequences of the worldwide coronavirus (COVID-19) pandemic is the closure of many, if not most, of the world’s underground mines. As workers in these mines work and live close to each other in working environments with limited practical options for improving respiratory conditions, large mining companies, regulatory authorities, and unions are starting to take the sensible decision to shut down mining operations. South Africa just issued an order to shut down all underground mines for three weeks. Other governments are taking similar actions, and I expect that almost every underground mine in the world will cease operating in the near future.

While it is tempting to believe that it will be easy to restore production at these mines, I have doubts, based on my personal knowledge of mining operations, that it will be possible to restore production at many mines without the expenditure of significant time and capital. Certain legacy mines would not comply with current stringent environmental regulations and may have trouble securing approval to reopen.

Underground mines account for 38% of the world’s primary gold production. At least 10% of these mines have already shut down, and announcements of new closures continue daily. Even if it is possible from an engineering or regulatory perspective to return, many of these closed mines to production, mining companies are bleeding out cash from the shock of mine closures and will need to access new sources of finances to restart operations, let alone survive.

It is hard for me to believe that this immediate and massive reduction in gold production will not impact the gold market and ultimately drive up the price of gold. However, the current situation is extraordinarily chaotic and not unequivocally bullish. The complete and total shutdown of the Indian economy resulting from coronavirus containment measures will negatively impact the Indian jewelry industry, which represents 20% of world gold consumption. Any negative shocks to the market from depressed jewelry consumption, however, will be dwarfed by the absolutely overwhelming demand for gold likely to emerge from investors.

More Examples of Supply Shock

JAMES ST. JOHN, WIKIMEDIA COMMONS

Platinum has had an even greater impact from the coronavirus as mines representing 68% of world production have also shut down. It is difficult to handicap the effect of this supply shock on prices as there will be inevitable destruction of consumption resulting from weakening global industrial activity. In my view, the overall implication is extraordinarily bullish for platinum prices. The extreme price swings in rhodium are the very first manifestation of the volatility that will flow into the entire PGM group of metals, including platinum.

Three major gold refineries in Switzerland temporarily suspended operations. The material cessation of gold refining will further amplify the shortage of refined gold resulting from the halting of underground gold mining. While it will not be hard to restore refinery operations, material disruption to gold refining will undoubtedly contribute to the rapidly emerging global gold shortage.

The real catalyst is the unprecedented explosion of money printing in the United States. The passage of the $2 trillion coronavirus economic bailout bill on top of “QEInfinity,” comprised of various special liquidity facilities from the Federal Reserve such as the Primary Market Corporate Credit Facility, the Secondary Corporate Credit Facility, Term Asset-Backed Loan Facility, the Money Market Mutual Fund Liquidity Facility, and the Commercial Paper Funding Facility, has pushed the global fiat monetary system down the “rabbit hole” of irreversible monetary experimentation, which will ultimately resolve in hyperinflation.

The disruption of supply chains and the destruction of the service economy means that there is a reduction in the availability of goods and services at a time of almost infinite monetary expansion. While the rendering of almost all productive humans into “couch potatoes” slows down the velocity of money, the lasting psychological damage of the policies enacted to contain the pandemic will erode productivity and further contribute to the harming of productivity from wasteful “green” and “ESG” virtue-signaling policies. Once the “mother of all USD short squeezes” settles down, I expect the degraded purchasing power of USD to manifest itself in general rising levels of prices.

About the Columnist: Famed “daredevil investor” James Passin, Chartered Market Technician, is Executive Chairman of Blockchain Holdings, Ltd. (symbol BCX on the Canadian Securities Exchange), a public company listed in Canada.