Editor’s Note: This is part of the ‘Money of British Monarchs’ series of articles.

By R.W. Julian

If someone had taken a public opinion poll in the summer of 1776 in what is now the United States, the list of “most disliked” undoubtedly would have been topped by King George III of Great Britain. Those who were in the process of rebelling against the Mother Country needed a convenient symbol of their grievances, and the king was an easy target. The grievances were real enough, but the king wasn’t really such an ogre.

The future King George III was born on June 4, 1738, the son of the Prince of Wales—Frederick Louis—and his wife, Princess Augusta. Frederick, the son of King George II (1727-1760), was unstable and a real thorn in his father’s side. The prince, however, died in March 1751 in a freak accident, after being struck in the head by a tennis ball.

Conflict of Nature Versus Nurture

The new Prince of Wales was raised by his mother with the help of George II, who saw in his grandson the making of an intelligent king with the best interests of the nation at heart. In this view, the king was quite right, but young George had inherited his father’s tendency toward mental problems and these would plague him for many years.

George grew up as a very moral individual with strong religious feelings. In August 1761, he married Princess Charlotte of Mecklenburg-Strelitz and they had 15 children between 1762 and 1783, something of a record for a royal couple, considering that the majority of them lived beyond their childhoods.

In late October 1760, George II died; the new king, at the age of only 22, was now called George III. One of his first acts was to help end the long and bitter Seven Years War, which had bedeviled Europe and America since 1756. George hated war and did all that he could to avoid it. Throughout his reign, however, there were constant struggles with a succession of ministers, both competent and incompetent, who tried to influence his decisions.

His first bout with mental illness came in January 1765, but the young king recovered quickly. On other occasions, he was not so lucky and in his latter years, after 1810, he was insane.

Outcomes of Independence

During the American Revolution, the king strongly supported those ministers who tried to keep America in the British fold—but in the end, the United States achieved its independence, an unpleasant outcome for the king and one which no doubt contributed to his increasingly troubled mental state.

There was another severe bout of mental problems in the late 1780s—then, in the early 1800s, the trouble got worse. By 1810, the king was no longer lucid and in 1811 his son, later to become George IV, was appointed regent and served until George III died in January 1820. (The years 1811-1820 have since been designated by historians as “Regency England.”)

When George III ascended the throne in late 1760, the state of British coinage was not all that good. There was a reasonable supply of copper coins for the poorer classes but virtually no British silver coinage in daily use.

Only small amounts of silver had been struck under George II after 1746, although there was a slight revival of such coinage in 1757-58. Gold mintages were relatively strong throughout George III’s reign, but these were used by the upper classes and for international trade, not the common people.

Curious Copper Coinage

George III’s first copper coinage, in 1762-63, used dies of his grandfather, George II. It is not clear why this was done, but perhaps the new king simply wished to honor George II in this odd way. There would be no more official copper coinage until 1770 at the London Mint, but in the meantime counterfeiters were very busily turning out fake halfpence and farthings. (Two farthings equaled a halfpenny.)

Mint records indicate that nearly £6,000 of silver coins was struck in 1762 and 1763, yet there is only one silver coin from these two years carrying George III’s portrait and this is the celebrated “Northumberland” shilling of 1763, whose mintage is known to be only £100, or 2,000 pieces. Northumberland had been appointed viceroy in Dublin—Ireland then being part of Great Britain—and the shillings were distributed by him to supporters in Ireland.

It is thought that the rest of the silver coinage recorded for the early 1760s, like the copper, carried the portrait of George II, though of what date is not currently known. For both copper and silver, it was an odd way to begin a reign.

Actually, silver coins do exist for many dates in George III’s reign, but these pieces did not circulate, nor were they intended to do so. We are speaking here of the famous Maundy Money, struck in very small amounts and handed out by the king or his representative to a select group of elderly citizens. This ceremony is still conducted each year, several centuries after its commencement.

Traditions of Treasury

The British Treasury was very conservative in its views about coinage and, despite seemingly endless appeals from the public for the issuance of circulating silver coins, it did virtually nothing. The price of silver was too high to permit coinage under the current laws, but the Lords of the Treasury refused to consider cutting the weight of the coins.

This is not to say that silver coins were not available to the public. As in Colonial America, small Spanish silver coins, especially the real and two reales, circulated fairly widely. The Spanish dollar (eight reales) was also often used in commerce, especially by the more affluent classes of society.

Unlike copper and silver, gold was struck on a regular basis—but also in a way firmly rooted in the past. In 18th-century Britain, there were no one-pound gold pieces; rather, the main gold coin was called the “guinea.” For reasons dating back a hundred years before George III became king, the gold pound was known by this name and was worth 21 shillings, instead of the usual 20 shillings to the English pound.

Traditions die hard in a country such as England, and until the 1968 changeover to the decimal system, it was common to see the price of an expensive item quoted in guineas rather than pounds, even though the last of the gold guineas had been struck in 1813. This particularly applied to the wealthier classes, which were expected to pay more than ordinary citizens.

Failure to Curb Counterfeiting

During the 1760s, the minting of counterfeit copper coins, especially halfpence, increased dramatically and a virtual torrent of bad coins was foisted on the public. The Treasury finally decided that enough was enough and issued orders to the Mint director, Charles Cadogan, to begin copper coinage.

The idea was to issue copper coins of full weight, which would put the lightweight counterfeit pieces in a bad light with the public and lead to their withdrawal. That was the plan, at any rate, but it didn’t work out in practice.

Between 1770 and 1775, several million farthings and halfpence were coined at the Tower Mint and many of these entered circulation. However, large numbers of them were bought up by the counterfeiters, who used the high-quality metal to put out their own lightweight products in even larger numbers. In 1775, the authorities called off the operation, tacitly admitting that they had been defeated by the counterfeiters.

One might ask why something was not done to stop the production of fakes. There were strict laws in the 18th century against such activity, but they really applied only to silver and gold coins. In a technical sense, the laws also applied to the coppers—but only if a counterfeit was a virtually exact copy. The forgers got around this inconvenience by simply striking “coins” with deliberately blundered legends, often to the point of making no sense whatsoever.

Questionable Practicality of Guineas

Most of the gold coins were either guineas or half guineas, but there was an odd striking of a quarter guinea in 1762.

In the late 1790s, the London Mint also began to strike one-third guineas to fill the growing demand for small change. As even a third of a guinea was a large sum to the common worker, one has to wonder how practical this was for marketplace transactions.

In 1787, there was a significant coinage of small silver coins, mostly shillings and sixpence (there were 12 pence in a shilling), but these were not struck for commercial reasons. Instead, the Bank of England felt that it needed to have a supply of small silver coins on hand for those needing a present for a small child at Christmas or on a birthday, a well-known custom then and now.

Except for the odd 1787 silver coinage, the Treasury simply permitted the public supply of money to deteriorate. Although counterfeiters were still busy plying their trade in copper, by the late 1780s they had legal competition from private minters. (In 1787, one Treasury study concluded that only about 7 percent of the coins then used in England “had some tolerable resemblance to the king’s coin.” The study was then quietly shelved and forgotten.)

Beginning in the late 1780s, the private minters struck increasing numbers of copper tokens, which were generally marked as being payable at some firm or other. These were usually of good copper, well struck and honestly issued by responsible firms. Because many of them were carefully cataloged in 1798 by an early numismatist, James Conder, modern collectors call these issues Conder tokens, a well-deserved tribute to that scholar.

Burden of Hefty Coinage

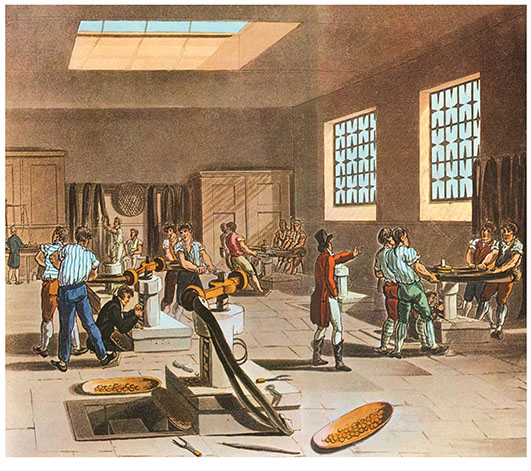

The beginning of the end for the old ways of British coinage occurred in the early 1770s, when budding industrialist Matthew Boulton became interested in the coining process. By 1786, he had progressed to the point where he obtained a lucrative contract to strike coins for India at the request of the East India Company.

During the late 1780s and early 1790s, Boulton repeatedly petitioned the British Treasury to give him a contract to strike copper coins that would contain nearly their full value in metal, unlike even the official issues of the past. At length, in 1797, the Treasury threw in the towel and awarded Boulton a contract to strike farthings, halfpence, pennies and two-penny (twopence) pieces. The last-named coin weighed two full ounces and the other coins were proportional.

Coinage was very heavy in 1797, but only the upper two values were struck at first, the lower two following in 1799 after a weight reduction. The British public was at first surprised and amazed at the quality and sheer size of the new coins—but once the novelty wore off, many citizens were less than thrilled at having to carry such heavy coins in their pockets or purses.

The striking of twopence pieces was not repeated, but there was a second round of coinage in 1806 for the other values on a lighter-weight standard.

The Boulton copper coinages of 1797-1806 provided Britain, for the first time, with stable and valuable copper coinage. There were, in fact, so many of these coins in daily use that some shopkeepers grumbled about the sheer number of them. This honest coinage also severely curtailed the use of the old counterfeits and Conder tokens, though such pieces continued to be used, usually downgraded to a lower value, such as a farthing for a coin that had once passed as a halfpenny.

One would think that Boulton’s copper coinage was an amazing accomplishment, but he was far from done with his coinage service to the government.

George III At Forefront of Countermarking

As a result of the ongoing war with France, which had erupted in the 1790s, the state of the silver coinage, which consisted mainly of worn Spanish coins, was getting worse. The Treasury decided to countermark Spanish dollars with a small head of King George III in order to validate them for use in Britain.

The London Mint applied these countermarks in great quantities, but before long counterfeiters turned their attention to the countermarking, taking advantage of the difference between intrinsic and official values. The Treasury once more threw in the towel and agreed to a suggestion by Boulton that he be permitted to overstrike the Spanish dollars with new dies.

Beginning in 1804 and continuing until at least 1811, Boulton restruck large numbers of Spanish dollars with new dies dated 1804. These had a dual value of one dollar or five shillings. (As these are genuine 1804 dollars, the American collector who cannot afford to own one of the famous U.S. dollars of that date can obtain the British version for far less money.)

The two operations by Boulton, while not providing minor silver, did have the saving grace of furnishing useful coinage to the British public at a time of national emergency. The war with France lasted until 1814, although there was a brief resurgence of military action in 1815 when Napoleon was able to return to France for the “100 Days” of a new regime. His dream was shattered at Waterloo.

Turning An Eye to Mintage System

From 1811 to 1816, the London Mint, which had moved into a splendid new building in 1810, struck an interesting series of silver coins, called “tokens” at the time—although today they are generally considered coins. There were two denominations: three shillings and 18 pence (1.5 shillings), and both were made at reduced weight by order of the Bank of England rather than the Treasury.

With the end of the Napoleonic Wars in 1815, the British Treasury for the first time did a thorough study of the economy and coinage with an eye to establishing a working system that would provide the public with a steady supply of coins and bank notes.

Beginning in mid-1816, gold, silver and copper coins all were struck on the pound system, the gold guinea being dropped from the coinage. By the time of the king’s death in 1820, the system was firmly established and was to serve the nation well until decimalization took over in 1968.